Perhaps if you live under a rock or in a cave, or don't watch TV, listen to the radio, read magazines or newspapers, walk down the street, or talk to anyone, you haven't heard that the economy is in trouble. Investment banks are collapsing left and right, there's not much available credit, the US dollar isn't worth very much.

What does that mean to you? Well, aside from making that planned trip to Europe exorbitantly expensive, it means you're suddenly going to find that your money isn't going that far. Two interesting bits I heard on NPR:

Salaries have not been keeping up with inflation. So, to substitute, people have been using credit of all types - home equity, credit cards, etc. That's sounds like a recipe for disaster.

We're in the worst economic times since the Great Depression, at least according to one commentator.

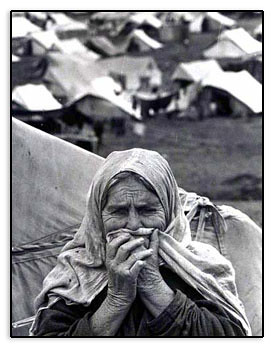

Remember those times in the 1930s? No, me niether. But I remember hearing my grandmother talk about it. She used to search in the couch cushions for loose change in order to be able to take the trolley to school. Until the day she died, she re-used everything, and her favorite places to shop were estate sales and garage sales. For a special treat, she'd take a look at the clearance rack at Marshall's. And all things considered, my grandmother and her family had it pretty good during the great depression - her mom was a physician.

I don't think most of us are quite at that level yet. To keep more of your money around, here three of my ideas for what you can do to save a little, but still have fun:

1. Go out to eat less. When you get the urge to go out, have just an appetizer and drink at the bar. Chances are that will be filling enough. Alternatively, order the food but not the liquor and you'll save a bundle (in both $$ and calories). My favorite way to eat new foods is to host a potluck! No, I'm not a mom, I'm a twenty-something who happens to love potlucks. Try it for yourself, it's fun.

2. Make gifts for birthdays and the upcoming holidays. You don't have to be all Martha Stewart to give something nice. For my friend's recent wedding, we all wrote memories and things we loved about her on pretty slips of paper, and put them in a decorative jar. Cost was minimal, and she absolutely loved it. Alternatively, you could pick up a frame at a garage sale, spiff it up with some spray paint, and put in a photo of you and the giftee or a meaningful quote of some sort.

3. Take public transportation, walk, or ride your bike instead of driving your car or taking a cab. You'll prevent road rage, avoid accidents, and save the earth, all while saving your moneys. Yes, you will have to budget in a little extra time, but it could be well worth it.

All these small behavioral changes can add up - try them, and you'll see!

What are some of your tips for pinching a few pennies?

Related Posts: It's the economy, stupid; What is this credit crisis you speak of, and why do I care?; Don't forget about your pet; An economic recovery plan, in a cup; The R-Word

No comments:

Post a Comment